change in net working capital meaning

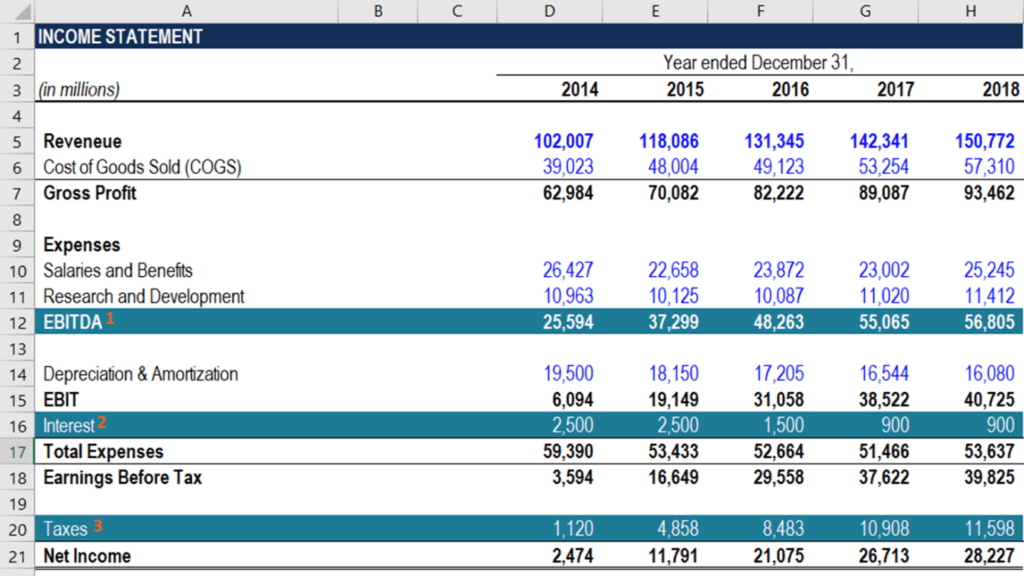

However we will modify that definition when we measureworking capital for valuation purposes. The Change in Working Capital tells you if the companys Cash Flow is likely to be greater than or less than the companys Net Income and how much of a difference there will be.

Changes In Net Working Capital All You Need To Know

What is the definition of NOWC.

. Whereas a negative change in net working capital means that your company might typically need to borrow money or increase finances to pay its current financial obligations. Means changes in accounts receivable adjusted for non-cash items plus changes in inventory adjusted for long-term and non-cash items less changes in accounts payable adjusted for royalties and rebates. The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period.

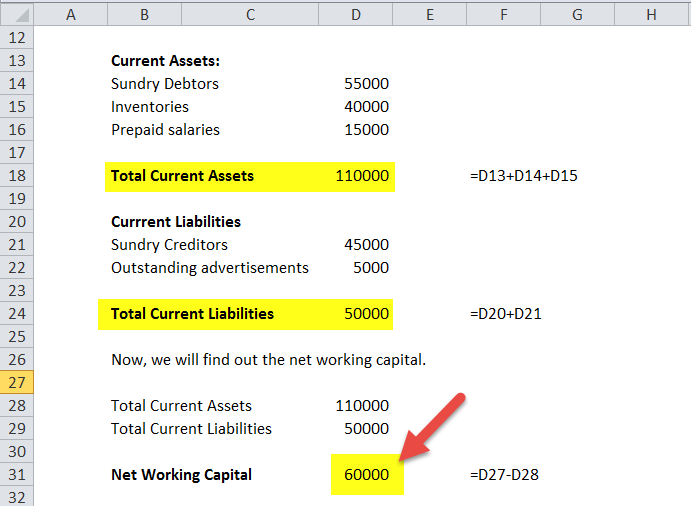

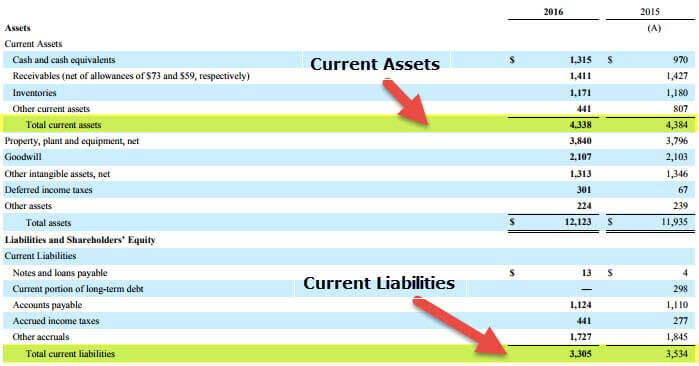

Definition Component Formular Calculation and More. The net working capital figure is more informative when tracked on a trend line since this may show a gradual improvement or decline in the net amount of working capital over an extended period. Working capital is the difference between a companys current assets and current liabilities.

Similarly negative change in net working capital means that current liabilities has increased in. The ratio measures a companys ability to pay off all of its working liabilities with its operational assets. Working capital can be negative if current liabilities are greater than current assets.

Net operating working capital NOWC is a financial metric that measures a companys operating liquidity by comparing operating assets to operating liabilities. Target Net Working Capital Amount means an amount equal to the four 4 quarter average NWC as defined in this paragraph for 2015 for the Business. Any change in the Net Working Capital refers to the difference between the Net Working Capital of two executive accounting periods.

Working capital is calculated as. A change in working capital is the difference in the net working capital amount from one accounting period to the next. Positive working capital is when a company has more current assets than current liabilities meaning that the company can fully cover its short-term liabilities as they come due in the next 12 months.

If the change in NWC is positive the company collects and holds onto cash earlier. Change in Working Capital means for any period the increase or the decrease of the difference between current assets net of cash and current liabilities net of short term debt and the current portion of long term debt as reflected on the Borrowers consolidated balance sheet delivered to the Agent and the Lenders pursuant to Section 91 or 93a of the Loan Agreement. Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities.

The duration of the cash conversion cycle reduces with this management and this directly impacts the cash flows in a productive. A positive change in net working capital means your business have enough liquidity to pay your current financial obligations as well as spend money for any type of research or development. This is because an increase in the Net Working Capital would mean additional funds needed to finance the increased current assets.

They are commonly used to measure the liquidity of a and current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due and. This means that for a company with positive net working capital NWC will grow as sales grow and be a use of cash. Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should not lie idle in future.

So this increase is basically cash outflow for the company. So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. If a companys owners invest additional cash in the company the cash will increase the companys current assets with no increase in current liabilities.

Change in Net Working Capital Formula Example 2. Therefore working capital will increase. Generally a 21 ratio of current assets to current liabilities is considered to be an adequate amount of net working capital.

What Does Net Operating Working Capital Mean. As a working capital example heres the balance sheet of Noodles Company a fast-casual restaurant chain. Workingcapital is usually defined to be the difference between current assets andcurrent liabilities.

However if the change in NWC is negative the business model of the company might require spending cash before it can sell. But if sales fall a scenario I worry about as a lender NWC may or may not shrink and free up cash to meet loan obligations. Working capital is a measure of both a companys efficiency and its short-term financial health.

Working capital is usually defined as net current assets excluding cash adjusted for any debt-like items such as unpaid corporation tax loans and hire purchase liabilities. Define Changes in Net Working Capital. Net working capital which is also known as working capital is defined as a companys current assets minus itscurrent liabilities.

Net working capital is defined as current assets minus current liabilities. As used herein NWC means a the Net Book Value of the current assets of the Business listed on Section B-2 of the Disclosure Schedule less b the Net Book Value of the current liabilities of the Business listed on Section. We will back out cash and investments in marketable securities from current assets.

There is no standard formula for how to calculate the NWC and every transaction is unique in this regard but any calculation must have regard to both timing and content. A management goal is to reduce any upward changes in working capital thereby minimizing the need to acquire additional funding. It means that the company has spent money to purchase those assets.

Examples of Changes in Working Capital. Simply put Net Working Capital NWC is the difference between a companys current assets Current Assets Current assets are all assets that a company expects to convert to cash within one year. The Change in Working Capital could positively or negatively affect a companys valuation depending on the companys business model and market.

As a business your aim is to reduce an increase in the Net Working Capital. Plus as revenues rise or fall net working capital tends to stay constant as a percentage of sales. So current assets have increased.

Therefore reduction in working capital greatly helps the companies to manage their cash cycles and ensure that they are able to get cash in a faster manner. As of October 3 2017 the company had 218 million in current assets and 384 million in current liabilities for a negative working capital balance of -166 million.

How Do Net Income And Operating Cash Flow Differ

Net Working Capital Definition Formula How To Calculate

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Definition Formula How To Calculate

Working Capital Example Formula

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Definition Formula How To Calculate

Change In Net Working Capital Nwc Formula And Calculator

What Is Working Capital Cycle Wcc

Working Capital Example Formula

Changes In Net Working Capital All You Need To Know

Working Capital Cycle Understanding The Working Capital Cycle

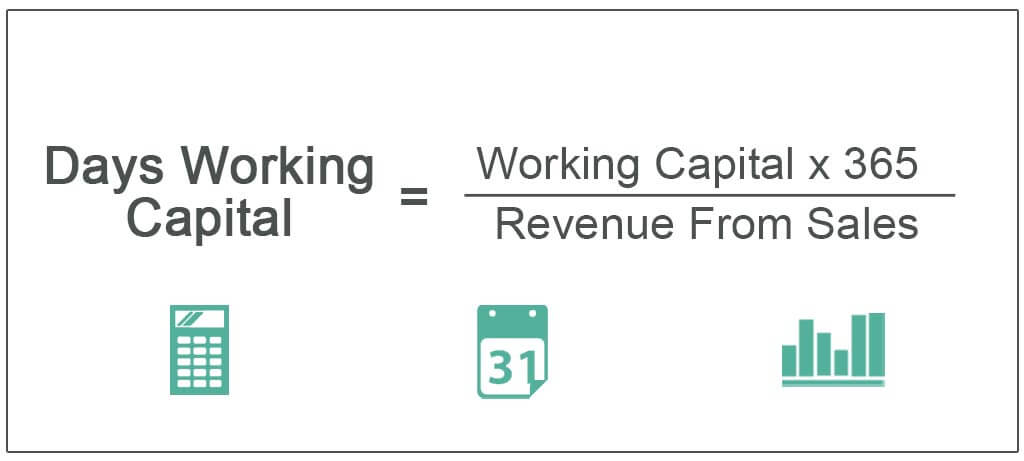

Days Working Capital Definition Formula How To Calculate

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Example Formula

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)